The latest publication of the Finance Invoice by Minister Jack Chambers has launched vital modifications to the pension panorama in Eire, writes Ronan McGrath

These modifications comply with the suggestions of the skilled assessment of the Commonplace Fund Threshold (SFT) and are set to impression Hospital Consultants and Common Practitioners (GPs) near or above the present €2m pension restrict (SFT).

Ronan McGrath, Oakwood Monetary Advisors

A Lengthy Overdue Constructive Adjustment – Greater and decrease advantages

The SFT has been mounted at €2 million since 2014, a interval throughout which common earnings have elevated by roughly 34 per cent. This stagnation has eroded the actual worth of the edge, successfully lowering the tax-efficient pension advantages out there to excessive earners. The headline change by the Division of Finance proposes is a rise to €2.8 million within the SFT by 2029. A change that’s lengthy overdue and vital to make sure that medical professionals can retire with dignity and with out extreme tax burdens.

Key Modifications Launched:

1. Enhance in Commonplace Fund Threshold (SFT):

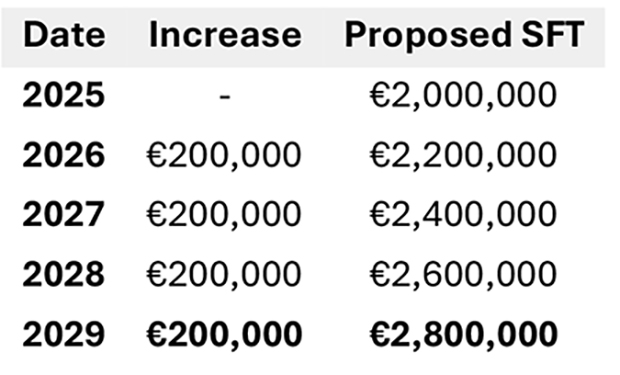

The SFT will likely be elevated from €2 million to €2.8 million by 2029, with phased will increase beginning in 2026. This adjustment goals to align the edge with inflation and earnings progress, offering higher tax effectivity for retirement financial savings. Future will increase from 2030 will likely be linked to wage inflation.

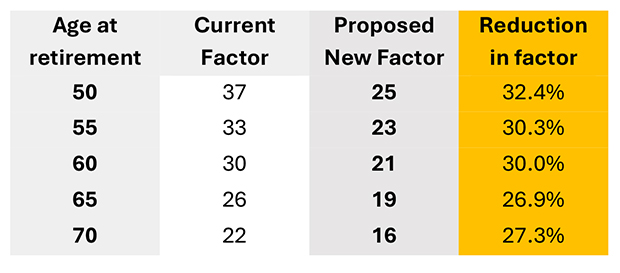

2. Discount in Income Elements:

Topic to an ‘unbiased valuation’, for future retirees the components used to worth Outlined Advantages pensions accrued after 1st January 2014 for the needs of the SFT to be lowered considerably from its present stage. For instance, the present issue of 30 making use of at retirement at age 60 can be lowered to 21, a big discount. Nonetheless, it’s unclear whether or not the brand new decrease components will apply to retirements in 2025 or solely from 2026 onwards.

3. Sustaining Lump Sum Limits:

The tax-efficient lump sum limits will stay at their present ranges, with the primary €200,000 tax-free and the following €300,000 taxed at the usual fee of 20 per cent.

4. Extra Suggestions:

The Finance Invoice additionally consists of provisions to take away age and earnings-related limits on private pension contributions and to permit any Chargeable Extra Tax (CET – tremendous tax in your pension) liabilities to be unfold over a 20-year interval.

Implications for Medical Professionals

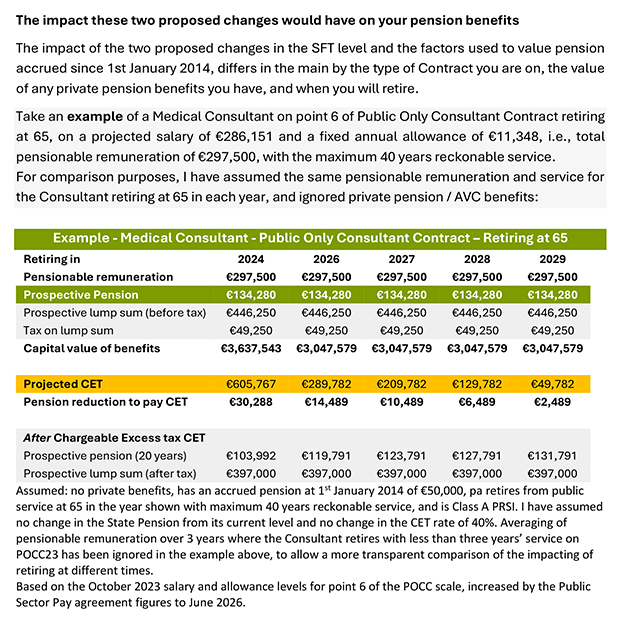

These modifications current vital alternatives for each Hospital Consultants and GPs above the present restrict to re-evaluate their retirement methods with their monetary advisor. The rise within the SFT will permit for greater tax-efficient pension advantages, whereas the discount in income components will decrease the CET legal responsibility, leading to greater internet retirement advantages.

For medical professionals, significantly these nearing retirement or nonetheless contemplating the Public Solely Advisor Contract, this does give scope for an enhanced pension in retirement. Consulting with a monetary advisor may help navigate the brand new panorama and maximize the advantages of the up to date pension laws.

Will any of those two modifications be backdated to Consultants who’ve already retired?

Sadly for individuals who have retired this yr and seeking to retire in 2025 there was no advice to backdate any of the proposed modifications. The rise within the Threshold is not going to apply till January 1, 2026 and due to this fact is not going to apply to retirements earlier than that date.

Retired Consultants, significantly those that retired within the latest previous and suffered vital discount of their public service pensions to pay for CET below the present SFT system, (brought about partially by means of greater components to worth their put up January 1, 2014 pension accrual) might due to this fact understandably really feel arduous carried out by.

Within the above generic instance, the mixed most good thing about the elevated Threshold, and decrease components, is a pension of about €28,000 pa, assuming the Advisor retires in 2029.

Political Uncertainty – The framing will likely be by the brand new authorities

Nonetheless, the proposed enhance will not be assured. Whereas these modifications are due from 2026, the timing of its implementation may nonetheless hinge on the result of the upcoming elections. The principle opposition celebration, Sinn Féin, advocates for a discount of the pension restrict (SFT) to €1.5 million. A stark distinction in coverage between the principle opposition and the present authorities.

Income Elements and Unbiased Evaluation

Arguably essentially the most vital change for Public Sector Workers (specifically Hospital Consultants) is the proposal to cut back the income components used to calculate pension values for tax functions.

Presently, these components considerably impression how pensions are assessed towards the SFT, usually resulting in substantial chargeable extra tax (CET) liabilities for these with advantages exceeding the edge, particularly for individuals who retire at youthful ages the place greater components are utilized. On a latest case we reviewed for a advisor early retirement (Psychiatrist with the flexibility to retire from age 55), the Chargeable Extra Tax lowered from over €1.1m to €190,000.

The assessment suggests decreasing these components, which might considerably cut back any Chargeable Extra Tax legal responsibility due. An unbiased physique will consider these suggestions earlier than they’re finalised. Nonetheless, no timeline has been set for this analysis which doesn’t augur effectively that this can come to go within the subsequent couple of years. Hospital Consultants ought to contact the IHCA and maintain the strain on the politicians to hold out this assessment. The IHCA have been proactively engaged on behalf of their members to get commitments to timelines on proposed modifications.

The Path Ahead

As we navigate this advanced panorama, it locations extra significance on reassessing your retirement technique to make sure you get the proper recommendation in gentle of those potential modifications. These nearing retirement and above the restrict, ought to contemplate delaying their retirement plans till the boundaries enhance. Furthermore, participating with a monetary advisor who understands these nuances is advisable in optimising retirement methods. The interaction between elevated thresholds and lowered income components (if they arrive to go) may create new alternatives for tax-efficient contributions and withdrawals for all retirees near the restrict.

Conclusion

The modifications launched by the Finance Invoice mark a optimistic step in the direction of enhancing retirement advantages for these approaching or above the present pension restrict. The upcoming election might play a vital function in figuring out whether or not these modifications come to fruition or if a reversion to stricter limits happens. ![]()

Info

Oakwood Monetary Advisors are specialist monetary advisors to the medical occupation, with a novel understanding of each the GMS Pension Scheme and likewise the Well being Service Govt pension advantages.

For extra info please contact Ronan at: ronan@oakwoodfinancial.ie or on 086 609 8615.

Oakwood Monetary Advisors is regulated by the Central Financial institution of Eire and solely recommends regulated funding merchandise.

Go to: https://www.oakwoodfinancial.ie/publications/

This has been an advertorial fature on behalf of Oakwood Monetary Advusors.